With plastic waste choking our oceans and landfills overflowing, businesses worldwide are desperately seeking sustainable packaging alternatives. Traditional packaging methods are failing both environmental and consumer expectations, leaving companies scrambling for eco-friendly solutions that don’t compromise on quality or cost-effectiveness.

Molded pulp packaging is a sustainable packaging solution made from recycled paperboard, newsprint, and natural materials like sugarcane bagasse, bamboo, and wheat straw. It’s rapidly gaining popularity due to its biodegradable nature, cost-effectiveness, and versatility across multiple industries. The global molded pulp packaging market is projected to grow from $7.01 billion in 2024 to $13.44 billion by 2034, representing a 6.73% annual growth rate.

Let’s dive deeper into why this eco-friendly packaging revolution is transforming how businesses package their products.

Table of Contents

ToggleWhat Exactly is Molded Pulp Packaging?

Understanding this sustainable packaging solution requires looking at both its composition and manufacturing process.

Molded pulp packaging, also known as molded fiber packaging, is an eco-friendly packaging material created from recycled paperboard, newsprint, and natural plant fibers through a specialized molding process that shapes the material into custom three-dimensional forms for product protection and presentation.

The manufacturing process involves several precisely controlled steps. First, raw materials including cardboard, newspaper, or natural fibers are blended with water to create a pulp slurry. A mesh forming tool is then lowered into the pulp slurry tank, where a vacuum pulls the slurry through the mesh tool until the desired thickness is achieved. The wet parts are released from the mesh tools and dried in an oven at approximately 205°C for 12 minutes.

To achieve smooth surfaces, the dried parts are pressed by heated metal tools, where debossed logos or artwork can also be applied. Finally, edges are trimmed and any holes or windows are die-cut to complete the packaging.

Unlike traditional folded cardboard boxes, molded pulp packaging features rounded corners and complex three-dimensional shapes with 5-10 degree draft angles and corner radii to facilitate release from forming and pressing tools. The raw materials help determine the color, surface texture, and physical properties of the final packaging product.

| Raw Material Type | Source | Key Properties |

|---|---|---|

| Recycled Paperboard | Post-consumer waste | Strong structure, cost-effective |

| Newsprint | Newspaper waste | Smooth finish, lightweight |

| Sugarcane Bagasse | Agricultural byproduct | Natural color, high strength |

| Bamboo Fiber | Fast-growing plant | Superior durability, moisture resistance |

| Wheat Straw | Farm residue | Natural texture, biodegradable |

This versatile material can be customized to fit virtually any product shape, making it an ideal replacement for traditional plastic and foam packaging across numerous applications.

How is the Molded Pulp Market Performing Globally?

The molded pulp packaging industry is experiencing unprecedented growth across all major markets worldwide, with multiple research sources confirming explosive expansion.

The global molded pulp packaging market demonstrates remarkable growth across multiple industry projections, with the market valued at $7.01 billion in 2024 and expected to reach $13.44 billion by 2034 at a 6.73% annual growth rate. Various research sources project market sizes ranging from $3.55 billion to $7.01 billion in 2024, all indicating strong upward momentum reaching $9.11 billion to $13.44 billion by the early 2030s.

The market performance varies by research methodology, but all sources confirm robust growth:

- Precedence Research projects growth from $7.01 billion in 2024 to $13.44 billion by 2034 (CAGR 6.73%)

- Research Nester estimates expansion from $3.55 billion in 2024 to $10.5 billion by 2037 (CAGR 8.7%)

- Straits Research values the market at $5.22 billion in 2024, growing to $9.34 billion by 2033 (CAGR 6.68%)

- Grand View Research expects the market to reach $9.11 billion by 2030 (CAGR 7.4%)

Regional performance shows distinct geographical patterns. Asia-Pacific holds the largest market share at 45% in 2024, valued at $3.15 billion and expected to grow to $6.12 billion by 2034 with a CAGR of 6.87%. The region’s growth is driven by rapid urbanization, a burgeoning middle class, changing consumer preferences for eco-friendly packaging, and strong manufacturing and export sectors.

Europe is estimated to observe the fastest expansion, with sustainability and eco-friendliness being dominant trends. European consumers and businesses place strong emphasis on environmentally responsible packaging solutions, with regulations and policies promoting sustainable packaging practices gaining significant traction.

North America shows steady growth, with the USA and Canada molded fiber pulp packaging industry projected to grow from $2.1 billion in 2025 to $3.5 billion by 2035, at a CAGR of 5.2%.

This robust market performance across all regions indicates unprecedented confidence in molded pulp as a viable long-term packaging solution.

What Industries Are Adopting Molded Pulp Packaging?

Molded pulp packaging has found widespread adoption across diverse industry sectors, each benefiting from its unique protective properties and sustainability advantages.

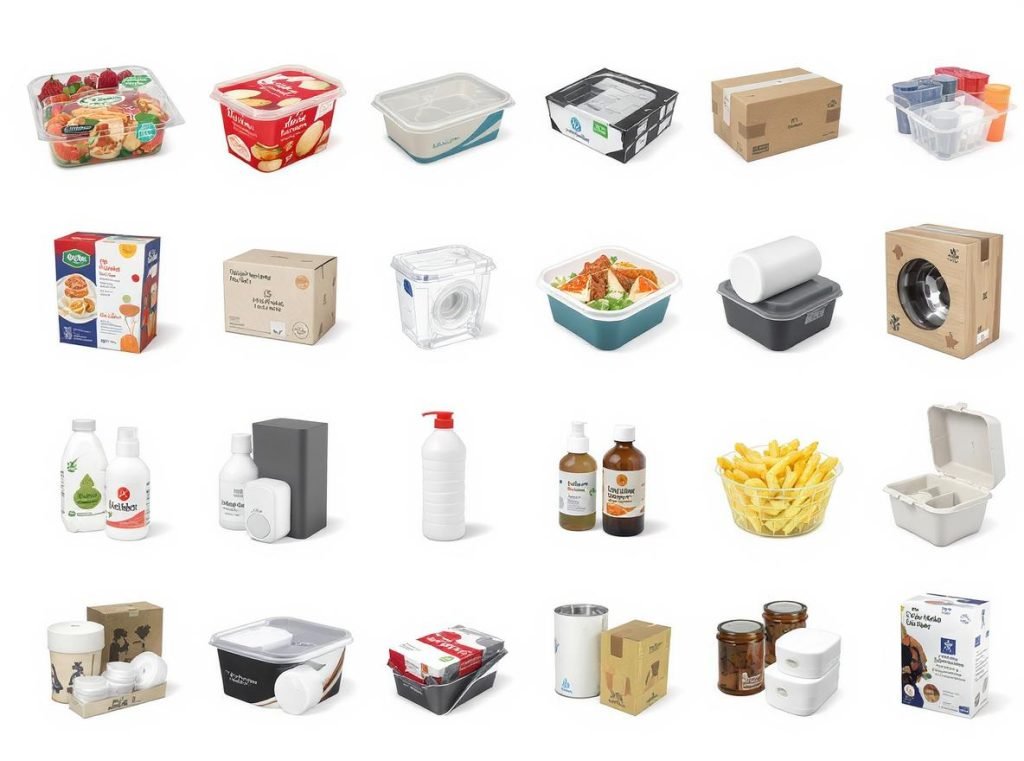

Food and beverage, electronics, healthcare, and consumer goods sectors are the primary adopters of molded pulp packaging. The food industry leads adoption at over 40% market share due to the material’s food safety and biodegradability, while electronics companies value its superior shock-absorbing and static-neutral properties for protecting fragile components.

The food and beverage sector dominates molded pulp packaging applications. Common uses include egg cartons and fruit trays, fast-food and takeaway containers offering sturdy and grease-resistant qualities, disposable food containers, plates, bowls, and serving trays, beverage carriers for coffee cups and soft drink bottles, and produce packaging for fruits, vegetables, and other perishable items.

Electronics manufacturers increasingly use molded pulp for protective packaging due to its superior shock-absorbing properties that prevent damage to delicate components and static-neutral characteristics, making it ideal for electronic components. Custom-fit designs cradle electronics like desktop computers, printers, cell phones, toner cartridges, set-top boxes, modems, and hard drives. Companies like Apple have developed elegant molded pulp inserts for iPhone packaging, showcasing how the material provides both protection and aesthetic appeal.

Healthcare applications continue expanding rapidly:

- Single-use medical packaging for instruments in surgical settings

- Biodegradable and eco-friendly products for clinical environments

- Packaging for medical devices and supplies such as syringes and diagnostic tests

- Hospital disposables including wash basins, kidney-shaped bowls, and coated clamshells that can be used in autoclaves

Consumer goods and retail sectors utilize molded pulp for personal care items, gift sets, toys, candles, and essential oils. Cosmetics and beauty products benefit from custom designs, with companies like L’Oréal incorporating molded fiber products. Automotive parts and household goods packaging, plus wine bottles and other glass products requiring excellent shock absorption, round out the diverse applications.

The versatility of molded pulp allows manufacturers to create industry-specific solutions that meet unique protection, presentation, and sustainability requirements.

What Environmental Benefits Does Molded Pulp Offer?

Environmental sustainability drives much of the growing interest in molded pulp packaging solutions, with quantifiable benefits across multiple impact categories.

Molded pulp packaging offers significant environmental advantages including 100% biodegradability within 90-180 days, 70% lower greenhouse gas emissions compared to plastic production, and the highest recycling rate of any packaging material at 82.6%. It decomposes naturally in 45-60 days under industrial composting conditions, contributing to circular economy principles.

Biodegradability represents the most compelling environmental advantage. Unlike plastic, which can persist in ecosystems for 500+ years, molded pulp is fully biodegradable and typically decomposes within 90-180 days in natural environments. In industrial composting facilities with controlled temperatures of 55-60°C, decomposition occurs even faster—often within 45-60 days. The resulting compost is rich in organic matter, ideal for agriculture or landscaping.

Carbon footprint reduction demonstrates measurable environmental impact. Molded pulp production generates approximately 70% fewer greenhouse gas emissions than plastic production. Producing 1 ton of molded pulp generates around 540 kg of CO2, significantly lower than plastic manufacturing. The production process releases approximately 1.7 kilograms of CO2 per kilogram of product, compared to 2.5 kilograms of CO2 per kilogram for plastic.

Advanced manufacturing operations running on 100% renewable electricity achieve even greater reductions, with some facilities showing potential greenhouse gas emissions reduction of up to 10 times compared to comparable plastic tray solutions.

| Environmental Factor | Molded Pulp | Plastic | EPS Foam |

|---|---|---|---|

| Biodegradation Time | 90-180 days | 500+ years | 500+ years |

| CO2 per kg Production | 1.7 kg | 2.5 kg | 2.3 kg |

| Recycling Rate | 82.6% | 39.8% | <5% |

| Composting Capability | Yes | No | No |

| Ocean Impact | Minimal | High | High |

Recycling and circular economy benefits further enhance environmental value. Molded pulp has the highest recycling rate of any packaging material at 82.6%, followed by metal (76.2%), glass (73.1%), plastic (39.8%), and wood (39.3%). The global recycling rate of molded pulp products exceeds 70%, vastly outperforming the plastic recycling rate of merely around 9%. The material can be recycled up to 7 times after fulfilling its primary purpose.

Resource conservation through recycled material utilization reduces demand for virgin resources. Using recycled materials in molded pulp production requires significantly less energy than producing new paper from raw wood pulp. A single ton of recycled paper used in molded pulp saves 17 trees, 7,000 gallons of water, and 4,000 kWh of energy compared to virgin paper production.

What Are the Economic Advantages for Businesses?

Cost considerations play a crucial role in packaging material selection, with molded pulp offering compelling economic benefits that contribute to its growing business adoption.

Molded pulp packaging offers significant economic advantages including material costs 70% lower than plastic alternatives, shipping volume reductions up to 50% through nestable designs, and substantial labor cost savings through formed-to-shape manufacturing. Direct material costs range from $50-150 per ton compared to plastic’s $800-1200 per ton, representing potential cost savings of approximately 70%.

Direct material cost comparisons reveal substantial advantages. Molded fiber pulp packaging typically costs between $50 to $150 per ton, significantly less than plastic, which ranges from $800 to $1200 per ton. This represents a dramatic cost advantage, with companies potentially decreasing packaging costs by approximately 70% when switching from plastic to molded pulp.

Real-world case studies demonstrate measurable savings. Keiding Inc. helped a customer packaging 50-pound mobile charging stations save $75,000 annually by switching from foam to molded pulp packaging. The innovative pulp design reduced box height from 29.75″ to 24.75″, achieving a 16.7% reduction in overall box volume, which led to $30,000 in warehouse and shipping cost savings. An additional $45,000 was saved simply due to the lower costs of the molded pulp product itself.

Shipping and storage efficiencies provide ongoing operational benefits:

- Nestable and stackable design cuts shipping volume by as much as 50%

- Stack of 40 molded pulp end caps shows 70% space savings compared to EPS equivalents

- Reduced shipping costs and easier storage minimize material waste

- Companies can move more units per truckload, optimizing logistics

Production and labor cost advantages emerge from the manufacturing process. Molded pulp products are formed to shape, eliminating assembly requirements and resulting in significant labor cost savings. The manufacturing process is relatively simple, and production savings can be implemented through methods like natural air drying for thick-wall pulp products.

Long-term financial benefits justify initial investments. The initial machinery setup for a medium-scale molded pulp production line ranges from $100,000 to $500,000, but companies benefit from long-term savings through reduced raw material costs, lower recycling fees, and decreased waste disposal expenses. Large orders can see cost reductions up to 20% due to economies of scale.

How Customizable is Molded Pulp for Different Products?

Product-specific packaging requirements demand flexible manufacturing capabilities and extensive design options to meet diverse industry needs.

Molded pulp packaging offers exceptional customization possibilities through 3D modeling and precise mold creation, enabling varying thicknesses from 1/16 inch to 1/4 inch and dimensions up to 30 x 30 inches. Advanced 3D printing technology has made creating detailed molds more cost-effective, typically costing between $1,000 to $5,000 depending on complexity.

Design flexibility begins with comprehensive 3D modeling and mold development. The molding process allows for varying thicknesses typically ranging from 1/16 inch to 1/4 inch, providing an optimal balance between durability and weight. Custom molded pulp items can be produced in dimensions as large as 30 x 30 inches, accommodating most packaging requirements across industries.

Surface finishes and textures offer extensive aesthetic options. Various surface finishes are available, ranging from smooth and luxurious to rough textures reminiscent of paper. The wet press process can achieve smooth surfaces with wall thickness from 0.7 to 1.5 mm, suitable for products requiring beauty and luxury appeal.

Shape and size adaptability demonstrates remarkable versatility. Molded pulp can be easily molded into various shapes and sizes to fit specific products. Whether creating molds from existing products, crafting designs from 3D drawings, or adapting former packaging methods, molded pulp embraces unique requirements across diverse applications.

Branding opportunities integrate seamlessly into the manufacturing process:

- Incorporated logos, brand colors, and design elements

- Silk screen options for branding directly onto pulp parts

- Debossed logos or artwork applied during the pressing stage

- Custom surface textures for enhanced brand recognition

| Customization Feature | Capability Range | Typical Applications |

|---|---|---|

| Wall Thickness | 0.7mm – 6.4mm | Electronics to industrial products |

| Maximum Dimensions | Up to 30″ x 30″ | Large appliance packaging |

| Draft Angles | 5-10 degrees | All molded products |

| Surface Finish | Rough to smooth | Luxury goods to utility packaging |

| Mold Complexity | Simple to intricate | Basic trays to multi-compartment |

Industry-specific customization examples showcase practical applications. Electronics packaging features custom-fit designs that cradle delicate items like smartphones, tablets, and laptops, minimizing the need for additional packaging materials while enhancing product presentation. Food and beverage applications include trays customized for specific food items with coatings or liners to resist moisture and grease, making them food-safe alternatives to plastic. Healthcare solutions offer molded pulp trays customized to hold medical devices and equipment with secure fits that reduce contamination risk.

Consumer goods versatility extends to packaging personal care items, gift sets, toys, candles, and essential oils with tailored protection and aesthetic appeal, demonstrating the material’s adaptability to virtually any packaging requirement.

What Challenges Does Molded Pulp Packaging Face?

Despite its significant advantages, molded pulp packaging encounters several limitations and challenges that businesses must carefully consider during implementation.

Molded pulp packaging faces primary challenges including moisture sensitivity that can compromise structural integrity, durability limitations with weight restrictions up to 10 kilograms, higher initial costs for small quantities due to custom mold requirements, and supply chain complexities where current demand exceeds available production capacity.

Physical and performance limitations present the most immediate concerns. Moisture sensitivity represents the primary limitation, as molded pulp’s susceptibility to moisture can lead to loss of structural integrity when exposed to wet conditions. This material can absorb moisture, potentially causing issues in humid environments or with products requiring moisture protection.

Durability concerns affect specific applications. Standard molded pulp may absorb shock less effectively than materials like styrofoam, which can offer up to 60% more protection against impacts. The material has weight limitations, typically suitable for items up to around 10 kilograms, beyond which it might compress or deform under pressure.

Design flexibility constraints limit certain applications. Compared to plastic, molded pulp has constraints in producing complex shapes and achieving extremely fine details. Sharp 90-degree angles are not feasible due to the need for draft angles during manufacturing, requiring design modifications for some products.

Economic and production challenges affect implementation decisions:

- Higher initial production costs, especially for small quantities due to custom mold creation

- Production line setup requirements increase per-unit costs for small-scale productions

- Custom tooling investments range from $1,000 to $5,000 depending on complexity

- Minimum order quantities often required to achieve cost-effectiveness

Supply chain complexities present ongoing challenges. Current demand for sustainable molded fiber packaging is exceeding supply capabilities, leading to potential delays and limitations for businesses seeking these solutions. Raw material sourcing and costs are subject to fluctuations, as molded pulp relies on recycled paper and natural fibers with variable availability and pricing.

Technical and manufacturing challenges require careful management. Compared to coated paper-based products, pulp molding lacks strong waterproof and oil-resistant properties, limiting its usability in high-temperature and high-humidity applications. The manufacturing process requires precise control to ensure consistent quality and performance across production runs.

Market and regulatory challenges affect broader adoption. Some consumers and businesses perceive molded pulp as lower quality compared to plastic packaging, requiring education and premium finishes to overcome these perceptions. Companies must navigate various regulatory requirements, and acquisition and import of raw materials can bring uncertainties to the market.

Most challenges prove manageable with proper design consideration, application selection, and strategic implementation planning, making molded pulp viable for the majority of packaging applications.

How Can Businesses Transition to Molded Pulp Packaging?

Successfully implementing molded pulp packaging requires strategic planning, systematic implementation, and careful attention to both opportunities and potential obstacles.

Businesses can transition to molded pulp packaging through a systematic six-step process: conducting comprehensive packaging audits, partnering with specialized suppliers, implementing controlled pilot programs, addressing common challenges proactively, developing communication strategies, and establishing monitoring systems. The transition typically requires 3-6 months for complete implementation with proper planning.

Step 1 involves comprehensive current packaging assessment. Begin by conducting a thorough audit of existing packaging materials and identifying areas where molded pulp can replace less sustainable options. Analyze your current packaging’s environmental and financial impact by examining material composition and recyclability, waste generation during production and post-consumer use, shipping costs and potential reductions with lightweight molded pulp, and products suitable for molded pulp packaging based on protection requirements.

Tools like lifecycle assessment (LCA) software or third-party audits can help quantify your environmental footprint and identify optimization opportunities for maximum impact.

Step 2 focuses on supplier research and partnership development. Find reputable suppliers specializing in molded pulp products, ensuring they meet quality and customization requirements. When selecting suppliers, consider material blends where additives like chitosan or PLA coatings can enhance water resistance for specific applications, design flexibility through advanced molding techniques that enable intricate shapes for various industries, and certifications ensuring suppliers meet standards like ASTM D6400 (compostability) or FSC-certified fiber sourcing.

Request samples for stress-testing to ensure the packaging meets your specific performance requirements before committing to large orders.

Step 3 emphasizes controlled pilot program implementation:

- Select high-visibility product lines that will demonstrate your commitment to sustainability

- Start small by piloting the change with one SKU or shipment type to minimize disruption

- Educate stakeholders by training staff on new packaging workflows

- Measure outcomes by tracking metrics like cost per unit, customer feedback, and waste reduction

| Implementation Phase | Timeline | Key Activities | Success Metrics |

|---|---|---|---|

| Assessment | 2-4 weeks | Audit current packaging, identify opportunities | Cost baseline, waste measurement |

| Supplier Selection | 3-6 weeks | Research partners, request samples, test performance | Quality standards met, cost comparison |

| Pilot Program | 6-12 weeks | Limited rollout, staff training, customer feedback | Performance metrics, customer satisfaction |

| Full Implementation | 3-6 months | Complete transition, optimize processes | Cost savings achieved, sustainability goals met |

Step 4 addresses common implementation challenges proactively. Anticipate and prepare solutions for typical obstacles including perceived quality issues addressed with premium finishes like smooth coatings or custom dyes, supply chain complexity managed through partnerships with localized suppliers to minimize transport emissions, and moisture protection enhanced through biodegradable coatings, though this may increase production costs by 5-10%.

Step 5 develops comprehensive communication strategies to highlight your sustainability commitment. Quantify environmental impact benefits such as “Our shift to molded pulp saved 15,000 kg of plastic annually,” emphasize consumer benefits like “Your unboxing experience is now plastic-free—compost packaging in your backyard!”, and demonstrate industry leadership by joining sustainability alliances and communicating commitment through marketing campaigns.

Step 6 establishes monitoring and reporting systems. Once implemented, continuously monitor the impact and report progress by tracking metrics such as waste reduction, cost savings, and customer feedback. Share results in CSR reports to enhance corporate image and demonstrate transparency. Use feedback to refine and improve your molded pulp packaging solutions continuously.

Best practices for successful transition include gradual implementation starting small with gradual integration of pulp-based alternatives, testing and gathering feedback by ordering samples and collecting customer input before full switching, leveraging innovation by staying updated on emerging trends like 3D-molded pulp and smart packaging features, and financial planning considering that although molded pulp may require 2-3× more initial investment than some alternatives, sustainable packaging benefits drive significant long-term cost savings.

The transition to molded pulp packaging represents more than just a material change—it’s an investment in sustainable business practices that can enhance brand reputation, reduce environmental impact, and position companies as leaders in the circular economy.

Summary

Molded pulp packaging represents a transformative solution addressing both environmental concerns and business packaging needs. With explosive market growth from $7.01 billion in 2024 to projected $13.44 billion by 2034 and widespread adoption across food, electronics, healthcare, and consumer goods sectors, this sustainable alternative offers compelling advantages including complete biodegradability, 70% cost savings over plastic, and exceptional customization capabilities reaching dimensions up to 30×30 inches.

Ready to transform your packaging strategy with sustainable molded pulp solutions that protect both your products and our planet? Contact Acreet today for expert consultation on custom molded pulp designs tailored to your specific industry requirements. Our experienced team specializes in helping businesses transition to eco-friendly packaging that enhances brand reputation while delivering superior product protection and cost savings.