The “Made in China” label has undergone a remarkable transformation in the packaging industry, evolving from a symbol of questionable quality to representing technological innovation and sustainable manufacturing excellence that shapes global markets.

The “Made in China” label in packaging has evolved from negative associations with cheap design and poor functionality to representing cutting-edge technology, sustainable practices, and quality leadership. Chinese manufacturers now hold 35% of global market share, up from 20% in 2019, with recall rates lower than global averages and advanced automation exceeding 50% of production processes.

This transformation represents one of the most significant turnarounds in modern manufacturing history, fundamentally changing how businesses worldwide approach packaging solutions and supply chain strategies.

Table of Contents

ToggleWhat Was the Original Perception of “Made in China” in Packaging?

The historical reputation of Chinese packaging was rooted in legitimate quality concerns that reached crisis levels in the mid-2000s, fundamentally damaging international confidence.

Originally, “Made in China” packaging was associated with cheap design, poor product quality, and serious functionality issues. The crisis peaked in 2007 when 67% of all consumer product recalls and 98% of toy industry recalls originated from China, earning 2007 the designation as “The Year of China Recalls.”

The packaging industry specifically faced several documented challenges:

The 2007 Quality Crisis: According to the U.S. Consumer Product Safety Commission (CPSC), 67% of all consumer product recalls, and 98% of product recalls from the toy industry, were of goods that had originated from China. This crisis was not merely perception-based but reflected real systemic issues.

Regulatory Framework Inadequacy: The U.S. Department of State and others argued that the problem arose from China simply growing too fast—the regulatory environment was unable to keep up with the pace of expansion that manufacturing was experiencing. The rapid industrialization outpaced quality control development.

Quality Reality vs. Perception: It was safe to say that in 2007, if something was made in China, it was more likely to have serious quality issues and be recalled than if produced in another country. This wasn’t stereotyping but reflected measurable quality differences.

| Year | Recall Statistics | Industry Impact |

|---|---|---|

| 2007 | 67% of all consumer recalls | Peak crisis year |

| 2008 | Highest recall numbers | Industry transformation begins |

| 2011 | Lower than global averages | Quality turnaround achieved |

Structural Manufacturing Issues: The problems stemmed from China’s rapid economic growth without corresponding quality infrastructure. In the past, the phrase “Made in China” conjured up negative associations: cheap design, poor product quality, poor functionality, and banal communication solutions.

Consumer Safety Concerns: The packaging industry was particularly affected because packaging quality directly impacts product safety and brand reputation. Many international brands experienced significant losses due to packaging failures and recalls.

This crisis period established the foundation for the dramatic transformation that would follow.

How Did China Transform Its Packaging Industry Reputation?

China’s transformation required systematic overhaul of manufacturing processes, quality systems, and regulatory frameworks, resulting in measurable improvements within just a few years.

China transformed its packaging reputation through strategic policy reforms, massive technology investments, and systematic quality improvements. After the 2008 peak in recalls, Chinese product recall rates declined significantly over three years, with 2011 levels lower than global averages from the previous year.

The transformation occurred through comprehensive initiatives:

Immediate Crisis Response (2008-2011): After a peak in product recalls of goods originating from China in 2008, the number of recalls experienced significant declines over the subsequent 3 years, to the point where 2011 levels for Chinese products were lower than for the rest of the world in the previous year.

International Quality Validation: China’s quality assurance body, the General Administration of Quality Supervision, Inspection, and Quarantine (AQSIQ) reported that in the first half of 2011, quality complaints from the European Union regarding Chinese imports declined by 45% year over year.

Strategic Industrial Development: China’s modern packaging industry has made rapid development since China carried out the policies of reform and opening to the outside. The government established the China Packaging Technology Association in 1980, marking organized industrial development.

- Implementation of comprehensive quality management systems

- Investment in advanced manufacturing technology and automation

- Development of skilled workforce through specialized training programs

- Establishment of international certification standards

Remarkable Growth Trajectory: In recent years, China’s packaging industry has made significant progress, with an annual compound growth rate of 16% from 2013 to 2017. The intelligent packaging segment alone grew from 125.52 billion yuan to 172.45 billion yuan between 2015-2019.

Global Market Leadership: Chinese manufacturers now hold 35% of the global market share, a dramatic increase from 20% in 2019. This rapid expansion reflects both improved quality and competitive positioning.

The transformation demonstrates how systematic approach to quality improvement can reverse decades of reputation damage in a relatively short timeframe.

What Role Did Technology Play in Improving Chinese Packaging Quality?

Technology became the cornerstone of China’s quality revolution, enabling precision manufacturing and intelligent quality control systems that surpass traditional methods.

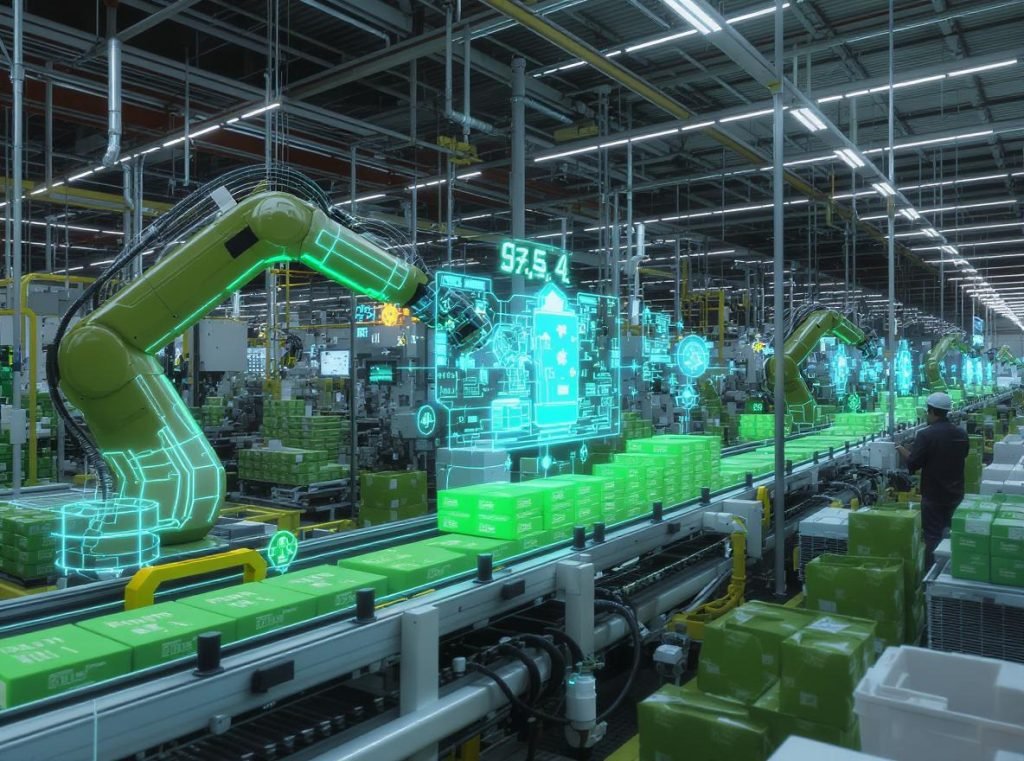

Advanced automation, digital transformation, and intelligent manufacturing systems revolutionized Chinese packaging quality. The proportion of automation in China’s packaging machinery now exceeds 50%, with AI-powered quality control and digital design capabilities enabling zero-defect production and dynamic customization.

The technological revolution encompassed multiple breakthrough areas:

Automation and Smart Manufacturing: The proportion of automation in China’s packaging machinery has exceeded half, which has laid a good foundation for the development of intelligence. This automation foundation enables consistent quality and rapid scalability.

Artificial Intelligence Integration: Chinese companies have embraced automation solutions, with human-robot collaboration and the use of artificial intelligence to manage intensive data processing. AI systems now monitor quality in real-time and predict potential issues before they affect production.

Major Industry Investments: Wahaha, the largest food and beverage manufacturer in China, has invested more than 20 billion RMB to introduce the world-class automated production lines, realizing the whole process of automation from raw materials to products packaging.

Intelligent Packaging Innovation: The rapid development of Radio-Frequency Identification (RFID) technology, a cornerstone of intelligent packaging, has played a pivotal role in propelling the industry forward. Patent applications in intelligent packaging surged from 6 to 151 between 2010 and 2018.

| Technology Area | Innovation Focus | Quality Impact |

|---|---|---|

| Automation Systems | 50%+ machinery automation | Consistent production quality |

| AI Quality Control | Real-time monitoring | Predictive quality management |

| RFID Integration | Smart packaging features | Enhanced product tracking |

| Digital Design | Dynamic customization | Precision manufacturing |

Digital Design Revolution: Digital design means that product modelling is the foundation of the process, improving the product design is the main activity, and data management is the core. This approach enables virtual modeling, process optimization, and data-driven quality improvements.

Advanced Manufacturing Capabilities: With digital design, we can even do dynamic design, involving virtual modeling, production process modeling, and optimized actual production. This comprehensive approach ensures quality at every stage.

This technological foundation has positioned Chinese packaging manufacturers as global leaders in both quality and innovation.

How Has Sustainability Transformed Chinese Packaging Manufacturing?

Environmental responsibility has become a defining characteristic of modern Chinese packaging, driven by government policy and market demand for sustainable solutions.

Chinese packaging manufacturers have embraced sustainability through comprehensive environmental policies, biodegradable materials development, and circular economy implementation. The sustainable packaging market reached $68.2 billion in 2023, with China leading in post-consumer recycled materials and closed-loop supply chains.

The sustainability transformation includes systematic changes:

Legislative Framework: From December 1, 2020, Hainan became the first province in China to legislate against nonbiodegradable plastic use. This legislation promoted fully biodegradable plastics widely applied in express delivery industries.

National Environmental Strategy: China’s “Green China 2030” initiative aims to reduce carbon emissions and promote environmental conservation. The country’s commitment to green manufacturing is part of its broader vision.

Biodegradable Materials Innovation: Fully biodegradable material is made of PBAT and PLA, and decomposes into water and carbon dioxide in compost within 180 days. Market adoption has been rapid, with 13 million fully degradable bags sold, including over 7 million during peak demand periods.

Market Growth and Demand: The sustainable packaging market in China reached $68.2 billion in 2023, driven by growing consumer demand for eco-friendly options. This growth reflects both policy support and market acceptance.

- Implementation of circular economy principles in packaging design

- Development of post-consumer recycled materials (PCR)

- Establishment of closed-loop supply chains

- Corporate environmental target setting by 80% of surveyed businesses

Corporate Environmental Commitment: 80% of surveyed businesses having set clear environmental targets, focusing on reducing material use, adopting biodegradable alternatives, and promoting recycling initiatives.

Circular Economy Leadership: China is leading in developing post-consumer recycled materials (PCR) and establishing closed-loop supply chains, ensuring that packaging materials are kept in circulation for as long as possible.

Companies like Acreet have integrated these sustainability practices into their core operations, offering clients environmentally responsible packaging solutions that meet both performance and regulatory requirements.

What Are the Current Competitive Advantages of Chinese Packaging?

Modern Chinese packaging manufacturers offer unique combinations of cost-effectiveness, quality, scalability, and technological innovation that create significant competitive advantages.

Chinese packaging manufacturers provide unmatched cost-effectiveness with European-level quality, massive production capacity, and advanced technology integration. With over 10,000 companies generating revenues exceeding CNY1.2 trillion and 87% planning international expansion, China dominates global packaging markets.

The competitive advantages span multiple proven dimensions:

Cost-Quality Balance: Chinese packaging materials have a cost advantage over those made in Europe, the Middle East, Southeast Asia, and the United States, and their quality is on the same level. Chinese manufacturing offers a key advantage in terms of cost-effectiveness. With lower labor and material costs, Chinese manufacturers can produce high-quality packaging at competitive prices, often surpassing domestic manufacturers.

Massive Production Capacity: Chinese packaging manufacturers have the capability to handle large order volumes, making them an ideal choice for businesses aiming to scale. As of the end of 2023, China had more than 10,000 packaging companies with annual revenues of over CNY20 million, with the total exceeding CNY1.2 trillion.

Advanced Technology Integration: China boasts state-of-the-art manufacturing facilities, making it a desirable source for packaging products. Access to advanced technology, combined with highly skilled labor, enables the production of a wide range of packaging types with a focus on precision and quality.

Global Expansion Strategy: 87% of Chinese packaging companies have already expanded overseas or have imminent plans to do so. This expansion is supported by the country’s Belt and Road Initiative and the international expansion of consumer brands.

| Advantage Category | Specific Benefits | Market Impact |

|---|---|---|

| Cost Efficiency | European quality at lower costs | 20-40% savings |

| Production Scale | 10,000+ companies, CNY1.2T revenue | Unlimited capacity |

| Technology | State-of-the-art facilities | Precision manufacturing |

| Global Presence | 87% international expansion | Worldwide service |

E-commerce Integration Excellence: Chinese e-commerce platforms handle mind-boggling volumes—billions of packages annually—yet maintain delivery times that would make Western companies sweat. This has led to precision packaging that saves resources and speeds delivery.

Supply Chain Sophistication: China’s packaging industry is also influenced by global events and trade dynamics, with significant production capacities and export activities contributing to its robust market presence.

For businesses seeking packaging solutions, Chinese manufacturers like Acreet offer the proven combination of quality, cost-effectiveness, and global service capabilities that can significantly enhance competitive positioning.

How Do Chinese Packaging Manufacturers Ensure Quality Standards?

Chinese packaging manufacturers have implemented comprehensive quality assurance systems that meet or exceed international standards, with measurable results in reduced defect rates and improved customer satisfaction.

Chinese packaging manufacturers implement ISO 9001 quality management systems, specialized industry certifications like ISO 13485 for medical packaging, and comprehensive risk management systems. These quality frameworks have enabled Chinese manufacturers to achieve recall rates lower than global averages while maintaining cost competitiveness.

The quality assurance framework includes multiple validated layers:

International Certification Adoption: ISO 9001 is one of the most recognized quality management standards globally, and Chinese suppliers increasingly obtain this certification to demonstrate commitment to quality management practices.

Specialized Industry Standards: For pharmaceutical packaging, Chinese manufacturers are achieving ISO 13485 certification, which recognizes companies for going above and beyond in their quality management systems for manufacturing injection molding parts and flexible packaging for non-active and non-implanted medical devices.

Comprehensive Risk Management: The industry has developed systems to mitigate and manage risk and self-maintained systems to measure and encourage internal improvement.

Quality Management Evolution: The transformation from crisis to leadership demonstrates the effectiveness of systematic quality improvement. The industry has developed robust quality systems that consistently deliver results.

- Statistical process control throughout production cycles

- Supplier quality management extending throughout supply chains

- Customer-specific quality programs for specialized requirements

- Continuous improvement culture with regular training and updates

Measurable Quality Improvements: The industry’s quality transformation is validated by objective metrics. Recall rates have declined significantly, and international complaints have decreased by substantial margins.

Advanced Quality Technologies: Quality assurance now incorporates AI-powered monitoring, predictive analytics, and real-time quality control systems that enable proactive quality management rather than reactive problem-solving.

International clients can confidently rely on Chinese manufacturers like Acreet to deliver consistent quality that meets their brand standards and regulatory requirements.

What Future Trends Are Shaping Chinese Packaging Innovation?

The future of Chinese packaging manufacturing is being shaped by intelligent technologies, sustainable innovation, and strategic government initiatives that position China as a global leader in packaging innovation.

Future trends include intelligent packaging with RFID sensors, massive e-commerce integration handling 175+ billion packages annually, sustainable innovation driven by new regulations, and the “Made in China 2025” strategy focusing on quality over quantity manufacturing.

Key trends driving innovation include:

Intelligent Packaging Evolution: RFID sensors are more suitable for smart packaging both in terms of sensing ability and data transmission. China is developing chipless RFID sensors that have the potential to achieve simpler, low-cost, more robust and less power-demanding sensors networks.

E-commerce Scale Integration: China’s parcel volume surged to over 175 billion in 2024, an increase of more than 21 percent compared with the previous year. This massive scale drives innovation in packaging efficiency and sustainability.

Regulatory-Driven Innovation: New regulations effective from June 1, aim to reduce packaging waste and environmental impact. These regulations accelerate development of sustainable packaging solutions.

Strategic Quality Focus: The “Made in China 2025” strategy aims to upgrade China from a manufacturer of quantity to one of quality. This initiative focuses on intelligent manufacturing and applying smart technologies.

| Innovation Area | Technology Focus | Market Impact |

|---|---|---|

| Smart Packaging | Chipless RFID sensors | Cost-effective intelligence |

| E-commerce Integration | 175B+ package efficiency | Precision packaging systems |

| Sustainability | Regulatory compliance | Environmental leadership |

| Quality Manufacturing | Intelligent systems | Premium positioning |

Manufacturing Excellence Initiative: The goal of raising domestic content of core components and materials drives innovation in proprietary technologies and materials.

Volume-Driven Innovation: The sheer scale of Chinese e-commerce packaging drives continuous innovation in materials, processes, and automation systems that benefit global markets.

Sustainability Integration: Environmental regulations and market demand continue driving innovation in biodegradable materials, circular economy systems, and waste reduction technologies.

Companies like Acreet are positioning themselves at the forefront of these trends, investing in intelligent manufacturing systems, sustainable practices, and global service capabilities to serve evolving international market demands.

Summary

The “Made in China” label in packaging has completed a remarkable transformation from the quality crisis of 2007 to today’s position as a global leader in sustainable, intelligent packaging solutions. Through strategic technology investments, comprehensive quality systems, and innovative sustainability practices, China has fundamentally redefined what the label represents in global markets.

Ready to experience the innovation and quality of modern Chinese packaging manufacturing? Contact Acreet today for a consultation on custom packaging solutions that combine cutting-edge technology, sustainable practices, and competitive pricing to enhance your brand’s market position.